The Saudi Central Bank (SAMA) plays a pivotal role in ensuring financial stability, security, and resilience across the Kingdom’s banking and financial sectors. In recent years, SAMA has introduced multiple regulatory frameworks—such as the Cybersecurity Framework (CSF) and Cyber Resilience Framework (CRFR)—to strengthen the sector’s ability to protect critical assets.

One such regulatory standard is the SAMA MVC Framework, designed to enhance Market, Value, and Compliance capabilities for financial institutions and fintech entities operating in Saudi Arabia. The MVC framework provides a structured model for governance, operational excellence, compliance monitoring, and market competitiveness in line with Vision 2030 goals.

This article will provide a complete guide to the SAMA MVC framework, its components, implementation best practices, challenges, and a service-based roadmap for organizations aiming to achieve full compliance. Read more: SAMA CSF

Understanding SAMA MVC Framework

The SAMA MVC Framework acts as a compliance and operational governance model tailored for Saudi Arabia’s financial ecosystem. It ensures that financial institutions, payment service providers, and fintech companies operate within strict regulatory, ethical, and operational standards.

Objectives of SAMA MVC

- Enhance market integrity by ensuring transparency and ethical business practices.

- Strengthen value creation for customers, investors, and stakeholders.

- Ensure compliance with SAMA regulations, anti-money laundering laws, and consumer protection guidelines.

- Promote operational resilience to withstand economic, technological, or cybersecurity disruptions.

Who Needs to Comply

The SAMA MVC framework applies to:

- Commercial banks

- Investment banks

- Insurance companies

- Fintech startups

- Payment service providers

- Digital wallets & online payment platforms

- Money exchange houses

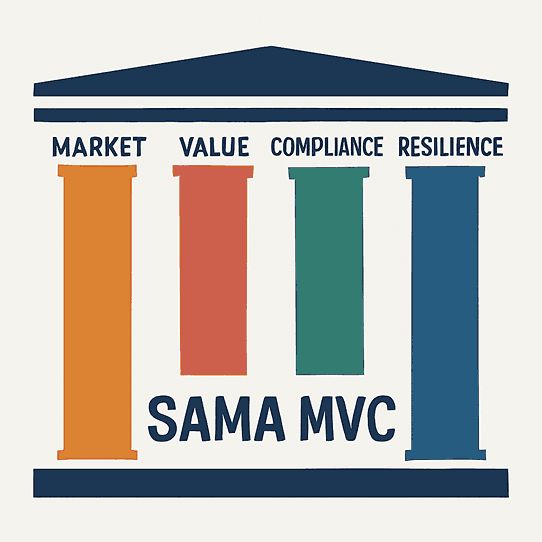

Pillars of the SAMA MVC Framework

The MVC framework is typically structured around four main pillars, ensuring both operational excellence and regulatory compliance.

| Pillar | Description | Key Compliance Requirements |

|---|---|---|

| Market | Ensure fair competition, transparency, and customer trust. | Accurate disclosures, ethical marketing, transparent fees. |

| Value | Deliver sustainable and innovative financial services. | Product innovation, service quality, customer-centric design. |

| Compliance | Maintain adherence to all SAMA laws and regulatory directives. | AML/KYC processes, reporting standards, internal audits. |

| Resilience | Build long-term stability in operations. | AML/KYC processes, reporting standards, and internal audits. |

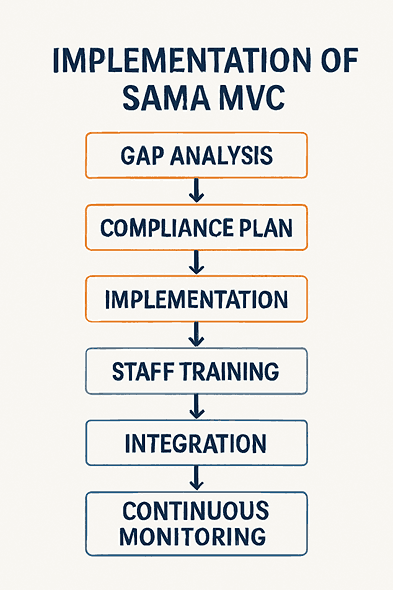

Implementation Roadmap for SAMA MVC

Successfully implementing SAMA MVC requires a structured, step-by-step approach. Below is a recommended roadmap:

| Step | Action | Outcome |

|---|---|---|

| 1 | Conduct a compliance gap analysis. | Identify missing processes and documentation. |

| 2 | Develop a tailored MVC compliance plan. | Aligns operations with SAMA MVC requirements. |

| 3 | Implement operational, governance, and reporting controls. | Enhances transparency and accountability. |

| 4 | Train staff on MVC principles and compliance procedures. | Builds organizational awareness. |

| 5 | Integrate technology for compliance automation. | Reduces manual errors and ensures timely reporting. |

| 6 | Perform regular audits and compliance reviews. | Maintains ongoing adherence to SAMA standards. |

Key Compliance Challenges

While implementing SAMA MVC, organizations often face certain challenges:

- Complex regulatory requirements leading to misinterpretation.

- Data integration issues when aligning with SAMA reporting formats.

- Limited internal expertise in compliance management.

- High costs of operational transformation.

- Resistance to change among employees.

Checklist for SAMA MVC Readiness

Below is a practical checklist organizations can use before undergoing a SAMA MVC compliance audit:

✅ Conduct a full regulatory gap assessment

✅ Appoint a compliance officer or team

✅ Document all policies & procedures

✅ Implement AML/KYC verification systems

✅ Train employees on compliance protocols

✅ Establish an internal audit mechanism

✅ Adopt cybersecurity best practices

✅ Maintain transparent customer communication

✅ Set up business continuity & disaster recovery plans

✅ Schedule regular regulatory reporting

Service Offerings for SAMA MVC Implementation

Many companies seek external consultants or managed compliance services to help them implement and maintain SAMA MVC compliance. Here’s how a service provider might structure their offerings:

| Service | Description | Benefit |

|---|---|---|

| Compliance Assessment | Review existing processes against SAMA MVC standards. | Identifies weaknesses early. |

| Policy Development | Draft and implement SAMA-compliant policies. | Ensures regulatory adherence. |

| Training Programs | Employee workshops on MVC best practices. | Improves compliance culture. |

| Technology Integration | Deploy tools for compliance automation and reporting. | Saves time and reduces risk. |

| Audit Support | Assistance in preparing for and passing SAMA inspections. | Minimizes chances of penalties. |

| Continuous Monitoring | Ongoing compliance tracking and updates. | Maintains year-round readiness. |

Visual Diagram Suggestions

For better understanding and blog engagement, consider adding the following diagrams:

- SAMA MVC Four Pillars Infographic – Circular or square graphic with Market, Value, Compliance, and Resilience.

- Implementation Flowchart – Showing steps from Gap Analysis to Continuous Monitoring.

- Compliance Checklist Table – Readiness checklist with tick marks for each requirement.

- Service Delivery Model Diagram – How consulting services support each MVC stage.

Best Practices for SAMA MVC Compliance

- Adopt a proactive compliance culture instead of reacting to issues.

- Use technology solutions for regulatory reporting and monitoring.

- Engage with SAMA updates regularly to avoid outdated practices.

- Involve top management in compliance oversight.

- Document everything — from policies to incident responses.

Conclusion

The SAMA MVC Framework is not just another regulatory requirement—it’s a strategic tool for ensuring sustainable, compliant, and competitive operations in Saudi Arabia’s financial sector. Businesses that invest in proper implementation can expect stronger market positioning, reduced legal risks, and improved customer trust.

By following a structured roadmap, using readiness checklists, and leveraging professional service providers, organizations can ensure they not only meet SAMA MVC requirements but also set themselves up for long-term success in the Kingdom’s evolving financial ecosystem.